Global asset management firm Schroders partnered with 8 Acre Perspective to conduct the fifth wave of its annual US Retirement Survey. The study, which was conducted in the spring of 2024 with 2,000 US consumers ages 28-79, examines Americans’ retirement readiness, their concerns about retirement and sentiment among current retirees.

Key findings:

- 51% of non-retired Americans are concerned about outliving their assets, yet 43% plan to take Social Security before age 67 (full retirement age for those born in 1960 or later), and just 1 in 10 plan to wait until age 70 to maximize their monthly social security benefit.

- 88% of non-retired Americans are at least slightly concerned about not knowing how to best generate income during retirement.

- 70% of those in a workplace retirement plan (e.g., 401k, 403b or 457 plan) identify their workplace plan as the single most important asset for their retirement, underscoring the critical role these plans play in American workers’ retirement security.

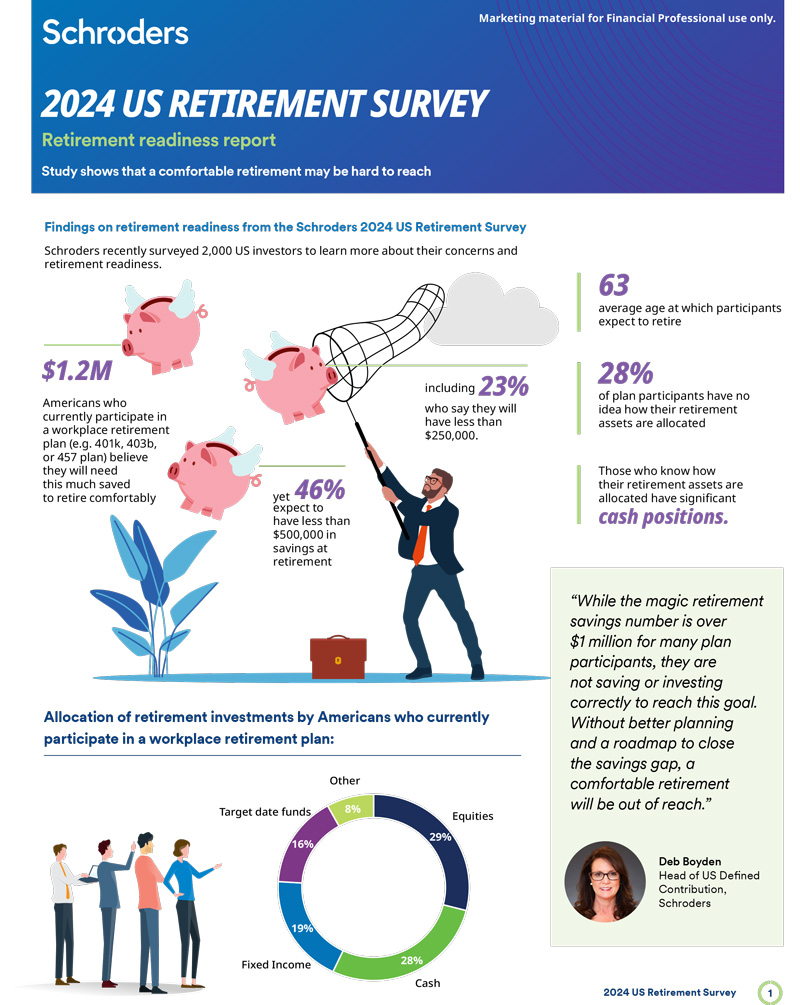

- Americans currently participating in a workplace retirement plan (e.g., 401k, 403b or 457 plan) believe they will need $1.2 million saved on average to retire comfortably, yet 46% expect to have less than $500,000 in savings at retirement.

- Just 32% of Americans are working with a financial advisor.

- Top concerns among retirees include inflation lessening the value of their assets (89% at least slightly concerned), higher than expected health care costs (85%) and a major market downturn significantly reducing their assets (76%).

This research has been cited in Barron’s, FA Magazine, CNBC, Investment News, MarketWatch, Kiplinger, PLANADVISER, and Yahoo! Finance, among others.

Click to Access Schroders Website

Click to Read Retirement Income Report

Click to Read Retirement Readiness Report

Click to Read Living in Retirement Report